Learn the Advantages and Disadvantages of ATM | Benefits and Drawbacks of ATM with their uses, types, applications, importance, and image in easy-to-understand language.

The full form of ATM is Automatic Teller Machine.

John Adrian Shepherd-Barron a British inventor was responsible for the development of ATMs he also lead the team who installed the first cash machine.

What is ATM and How it works?

ATM stands for Automatic Teller Machine. It is a device or machine you can use to withdraw as well as deposit money with the help of an ATM card.

We withdraw money from ATMs in different places using ATM cards issued by our banks with our bank accounts linked to them.

ATM cards are linked to our bank account details, also ATM cards are issued by bank authorities.

In the past, we had to go to the bank to withdraw money. We had to fill out a withdrawal slip and stand in line or long queue, later we used to withdraw money from our account.

Nowadays, we can withdraw cash from an ATM center, whenever we need money with the use of our ATM cards.

Nowadays, some banks offer money deposit machines to deposit money or transfer it to another person’s account using ATM cards.

ATM cards are used to make payments in online and offline transactions, such as booking movie tickets, buying transportation tickets such as buses, trains, and cars, and shopping online.

The ATMs are data terminals consisting of a keyboard and monitors like some input-output devices, also it is connected to a host processor allowing them to transfer data from the host to the ATM.

To withdraw money from an ATM, an internet connection is required also it is mandatory.

Whenever we withdraw money from the ATM, we need to insert the ATM card into the machine.

It reads the card’s information, checking the complete details of the cardholder such as name, account number, date of issue, and expiry date of the cardholder which are stored in the black magnetic strip ATM card.

Once the machine reads the data, it accepts the ATM card and is ready for further processing; then, we choose the withdraw option later the device connects the ATM holder and their bank account for electronic fund transfer.

When the process is completed then the host approves the machine to give the cash to the ATM cardholder.

Some banks provide money deposit machines; you deposit money to your bank account and send money to the other bank account, so you don’t need to go to the bank to deposit money.

Advantages and Disadvantages of ATM | Pros and Cons of Using ATM With Image

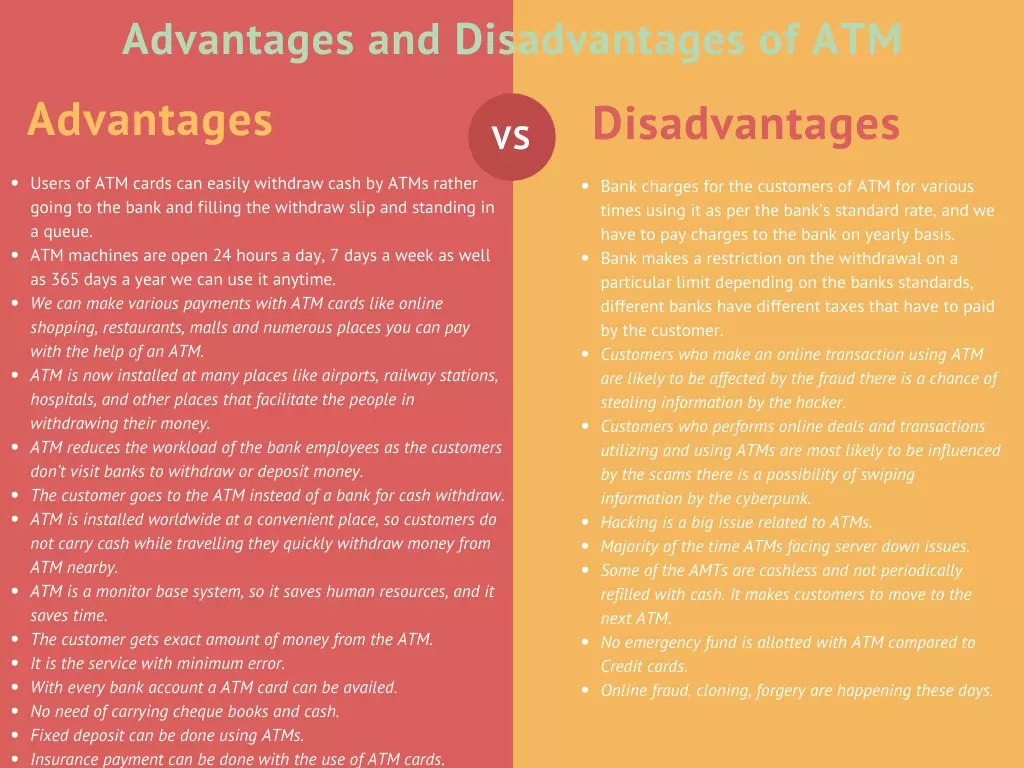

Benefits and Advantages of ATM in Points

- Users of ATM cards can easily withdraw cash by ATMs rather than going to the bank and filling out the withdrawal slip and standing in a queue.

- ATM machines are open 24 hours a day, 7 days a week as well as 365 days a year we can use them anytime.

- We can make various payments with ATM cards like online shopping, restaurants, malls, and numerous places you can pay with the help of an ATM.

- ATMs are now installed at many places like airports, railway stations, hospitals, and other places that facilitate people withdrawing their money.

- ATM reduces the workload of bank employees as the customers don’t visit banks to withdraw or deposit money. The customer goes to the ATM instead of a bank.

- ATMs are installed worldwide at convenient places, so customers do not carry cash while traveling they quickly withdraw money from ATMs nearby.

- ATM is a monitor base system, so it saves human resources, and it saves time.

- The customer gets the exact amount of money from the ATM.

- It is the service with minimum error.

- With every bank account, an ATM card can be availed.

- No need to carry checkbooks and cash.

- Online shopping made extremely easy with the use of ATM cards.

- Can trace your account balance anytime using ATMs.

- Fixed deposits can be made using ATMs.

- Income tax filing can be done.

- Insurance payments can be made with the use of ATM cards.

- The personal loan can be applied using an ATM.

- Card-to-card fund transfer is possible with ATMs.

Drawbacks and Disadvantages of ATM in Points

- Bank charges for the customers of ATM for various times using it as per the bank’s standard rate, and we have to pay charges to the bank on a yearly basis.

- Bank makes a restriction on the withdrawal on a particular limit depending on the bank’s standards, different banks have different taxes that have to be paid by the customer.

- Customers who make online transactions using ATMs are likely to be affected by fraud there is a chance of stealing information from the hacker.

- Customers who perform online deals and transactions utilizing and using ATMs are most likely to be influenced by scams there is a possibility of swiping information by cyberpunk.

- Hacking is a big issue related to ATMs.

- Majority of the time ATMs face server-down issues.

- Some of the AMTs are cashless and not periodically refilled with cash. It makes customers move to the next ATM.

- No emergency fund is allotted with ATMs compared to Credit cards.

- Online fraud, cloning, and forgery are happening these days.

Useful Video on: Advantages and Disadvantages of ATM | Benefits and Drawbacks of ATM

People Are Also Reading

- Advantages and Disadvantages of Microcontroller

- Advantages and Disadvantages of Magnetic Disk

- Advantages and Disadvantages of Optical Disk

- Advantages and Disadvantages of Microprocessor

- 20 Advantages and Disadvantages of Mobile Phones

- Advantages and Disadvantages of CRT Monitors

- Advantages and Disadvantages of CCTV Cameras

- Advantages and Disadvantages of Blu-Ray Disk

- Advantages and Disadvantages of Fifth Generations of Computer System

- Advantages and Disadvantages of Bluetooth

- Advantages and Disadvantages of Thermal Power Plant

- Advantages and Disadvantages of Speakers

- Advantages and Disadvantages of Barcode Reader

- Advantages and Disadvantages of EDI {Electronic Data Interchange}

- Advantages and Disadvantages of FTP {File Transfer Protocol}

- Learn Computer Fundamentals

- Computer Basic Tutorials

What are the Types of ATMs?

- The ATMs inside the bank’s compound are called onsite ATMs.

- The ATM machine located outside the compound of the financial institution or bank is called an offsite ATM.

- The ATMs are established by non-banking economic and financial companies as well as use all the services are known as white label ATMs.

- Banks do not own ATMs. Instead, they are taken on lease to supply the service to the client and are called brown label Bank or financial institution

- Orange-label banks are used to share transactions.

- Pink labels ATMs are only for women.

- Eco-friendly labels ATMs are installed for the purchase connected to agriculture.

What is the Importance of ATMs?

Earlier we didn’t have ATM machines, so we intended to carry money for acquiring goods or household stuff or to pay our bills.

Therefore cash payment was the only means to perform business and deals which were risky at times.

At times being cashless restricted our power to purchase goods.

When individuals make use of the ATM machine, which is so simple to use and avoid lugging much cash with them.

While traveling we don’t need cash these days as anything can be paid with ATM cards or cash withdrawals can be done using ATMs.

Uses of ATM

ATM is used for withdrawing money, checking balance, transferring money, or changing the PIN (Personal Identification Number).

New and advanced ATMs also provide the option to withdraw a fixed deposit (FD) or apply for a loan.

You can also book tickets for the railway, pay insurance, mobile recharge deposit cash, etc.

5 Features of ATMs

| 1 | ATMs are easy to simple to use. |

| 2 | ATMs can be operated with multiple languages of your choice. |

| 3 | Account balance can be checked with just a few clicks. |

| 4 | The amount can be withdrawn. |

| 5 | Money can be deposited. |

Frequently Asked Questions [FAQs]

Who Developed ATM?

Don Wetzel.

In Which Country First ATM is Setup?

Barclays Bank in the UK in 1967.

Which Type of ATM Card is Better?

VISA ATM Cards

What are the Three Advantages of ATMs?

Can Withdraw cash 24*7.

Can Deposit money anytime the user needs.

Simple and Convenient to use and handle.

Get In Touch

I have also written and compiled some articles on computers and telecommunications, and please go through them.

I hope you will like reading it.

I hope that all the questions and queries related to Advantages and Disadvantages of ATM | Benefits and Drawbacks of ATM have been answered here.

If you have any questions related to the Pros and Cons of using ATM.

Don’t hesitate to get in touch with me, and if you need to add, remove or update anything from the article, please let me know in the comment section or via email.

I will be more than happy to update the article. I am always ready to correct myself.

Please share this article with your friends and colleagues; this motivates me to write more related topics.

!!! Thank You !!!