Introduction To Computers in Insurance Sectors

The modern computer system plays an essential role in the insurance sector and companies related to finance, loan, and insurance. Computers are capable of maintaining and managing some important tasks and operations more efficiently compared to humans.

Computers can significantly improve customer relationships and service, efficiently managing risks and organizing customer data and information.

Policy holders can use and utilize modern computer systems for innovative ideas, market analysis, predictions, and edge over competitors.

Advanced computer algorithms and software such as Machine Learning [MI] and Artificial Learning have amazingly changed the working style of the insurance sector.

The significant characteristics and features dramatically increased applications and uses of computers in insurance sectors and companies.

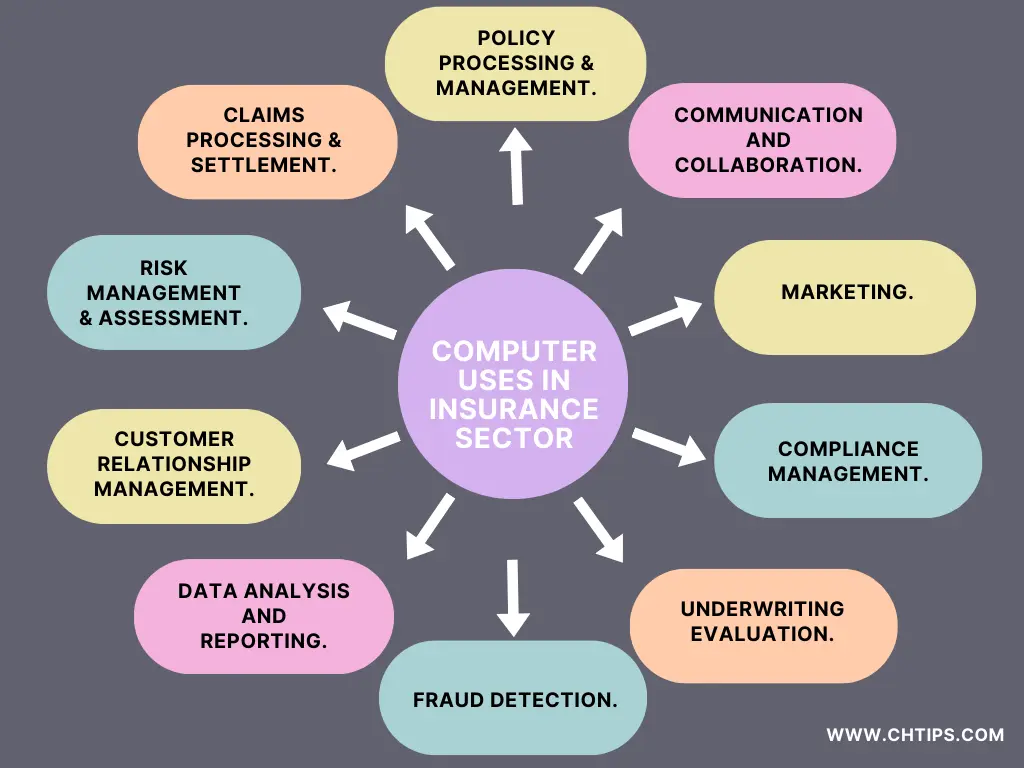

10+ Uses of Computers in Insurance Sectors in Tabular Form

There are effective uses of computers in insurance sectors. Some of them are included below.

| 1 | Policy Processing & Management. |

| 2 | Claims Processing & Settlement. |

| 3 | Risk Management & Assessment. |

| 4 | Customer Relationship Management. |

| 5 | Data Analysis and Reporting. |

| 6 | Fraud Detection. |

| 7 | Underwriting Evaluation. |

| 8 | Compliance Management. |

| 9 | Marketing. |

| 10 | Communication and Collaboration. |

| 11 | Data Analytics. |

| 12 | Document Management. |

1. Policy Processing & Management.

Modern computers are used and utilized to process applications for insurance policies, including underwriting and rating.

Policy Processing and management include tasks and activities related to creating, updating, renewing, and managing insurance policies related to people.

Some of the tasks that are included in Policy Processing and Management.

- Underwriting.

- Policy Issuance.

- Renewals.

- Endorsements.

2. Claims Processing & Settlement.

The claims and settlements requested or demanded by users | and clients are done automatically with advanced application software using computers with tremendous processing power.

The computer system helps and assists the process of claims and settlement to be done faster and more accurately.

The computer system using the software can eliminate the time consumed in finalizing Claims Processing & Settlement when done manually.

3. Risk Management & Assessment.

Modern computer systems are equipped and capable of identifying and recognizing the risk included in insurance-related losses.

The computers can also check the data and information of the policy holder for further processing and handling for better results.

4. Customer Relationship Management.

Customer Relationship Management [CRM] software is used in insurance companies using computers. This software stores the data and information related to the customers.

Later this data | information is further processed and handled to derive relevant results. The CRM can track customer data, customer interaction, complete policy details, and track customer satisfaction and retention.

Computers are also used to improve client communication for convenience and betterment.

5. Data Analysis and Reporting.

The computer system with intelligent software and an internet connection can analyze and identify data and information related to customers and policy-holders.

The system can help users identify trends in insurance markets, helping insurers make informed pricing and product development decisions.

This helps users to take appropriate actions regarding their needs.

The reporting can immensely help users to analyze massive amounts of data and information, make decisions based on data and predictions made by computers, and generate reports on key performance indicators with strategic planning.

6. Fraud Detection.

The computer can quickly identify any illegal and fraudulent activities associated with insurance fraud.

The reports and predictions made by computers can immensely help and assist in eliminating any such illegal activities.

The computer can present results and analysis at speed and with almost 100% accuracy; the results derived can save time and effort when done manually.

Advanced computer algorithms and software applications can scan data and information to detect suspicious patterns.

7. Underwriting Evaluation.

Computers can evaluate underwriting criteria and predict the likelihood of certain risks, reducing the risk of insuring loss-prone clients.

Computer systems help insurance companies assess risk by analyzing data, evaluating applicants’ profiles, and determining appropriate premium rates based on various factors.

8. Compliance Management.

The computers are used in managing regulatory compliance requirements.

9. Marketing.

Computers with an internet connection can easily communicate with potential clients over social media, emails, text messages, and other digital channels.

10. Communication and Collaboration.

Computers can easily communicate and can collaborate with professionals and clients. Computers can share crucial information and data online to update each with the latest information.

Here are some uses of computers in insurance sectors and companies. As technology is updating almost daily, the role of computers in the insurance sector is playing an important role.

They are making the tasks and operations related to insurance more efficient, fast, and accurate.

What is the Importance of Technology in Insurance Industry?

There are some significant 6 benefits of technology in the insurance industry. Some of such are mentioned below.

- Improved & Enhanced Operational Efficiency.

- Enhanced Customer Experience.

- Accurate Prediction of Risk Management.

- Agile Product Development.

- Fraud Detection and Prevention.

- Regulatory Compliance.

Uses of Computers in Insurance Sector and Companies Using Infographics

Uses of Computers in Insurance Sectors PDF Download

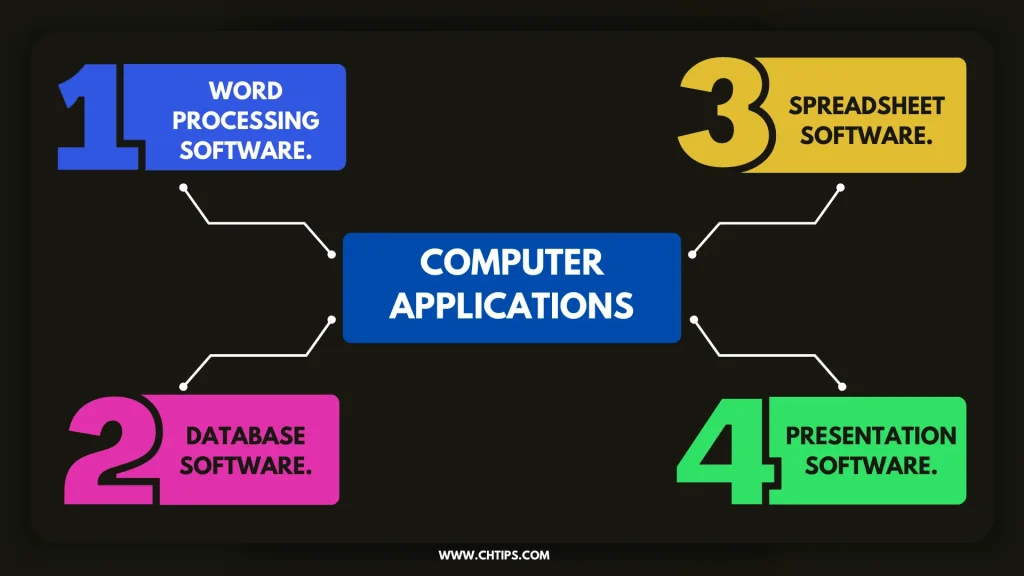

What are the 5 Major Computer Applications?

Various computer applications are designed and developed to derive various outputs and perform particular tasks and operations.

Here 5 Major Computer Applications are included that are widely used and utilized.

- Word Processing Software.

- Spreadsheet Software.

- Presentation Software.

- Database Software.

- Graphic Design Software.

7 Common Uses of Computers in Society?

- Education

- Technology

- Business

- Medical Fields

- Home

- Hospitals

- Banking

Role of Technology in the Future of Insurance?

Modern technology has dramatically changed the way businesses operate these days. Undoubtedly, technology will reshape the insurance and finance industry from top to bottom.

We can easily witness the changes that have already begun.

I have included some of the key areas where technology has shown a great deal of impact.

- Customer Satisfaction.

- Risk-Free Business.

- Using Artificial Intelligence and Machine Learning.

- Telematics and Wearables.

- Claims Processing and Fraud Detection.

- Blockchain and Smart Contracts.

- Cybersecurity and Data Privacy

Modern technology like Artificial Intelligence and Machine Learning will significantly improve and enhance the working style of insurance and finance companies.

When applying this modern technique, it will derive great evident results.

What are the Benefits of Insurance Technology?

There are several benefits of insurance technology. Some are included below.

- Enhanced Performance.

- Speedy Results.

- Data and Information Storage.

- Efficient and Reliable.

- Improved Customer Experience.

- Risk Assessment.

- Reports And Statics.

- Increased Transparency.

Useful Video: Applications and Uses of Computers in Insurance Sectors

What are the 5 Basic Types of Insurance?

- Health Insurance.

- Motor Insurance.

- Home Insurance.

- Fire Insurance.

- Travel Insurance.

5 Applications of Computers in Insurance Sector

- Customer Services.

- Risk Management.

- Actuarial Analysis.

- Sales and Marketing.

- Policy Management.

Computer Brands Used in Banks and Insurance Sector

Recommended Reading

- Is Computer Insurance Worth it for IT Professionals

- Top 10+ Uses of Computers in Banking Sectors

- Top 10+ Uses of Computers in Insurance Sectors

- How Computer Consultant Insurance Empowers Business

- Computer Basic Tutorials

5 Advantages and Disadvantages of Computer System

| # | Advantages of Computers | Disadvantages of Computers |

| 1 | Speed | Health Issues |

| 2 | Accuracy | Spread of Pornography |

| 3 | Stores Huge Volumes of Data & Information. | Virus and Hacking Attacks |

| 4 | Online Trading | Computer Can Not Take Their Own Decision and have NO IQ |

| 5 | Online Education | Distance Learning | Data and Information violation |

| 6 | Research | Negative Effect on the Environment |

| 7 | Forecasting Weather, Predicting Earthquakes, and Volcano Eruptions | Crashed Networks |

| 8 | Adverse Effect on the Environment | Spread of Violence and Hatred |

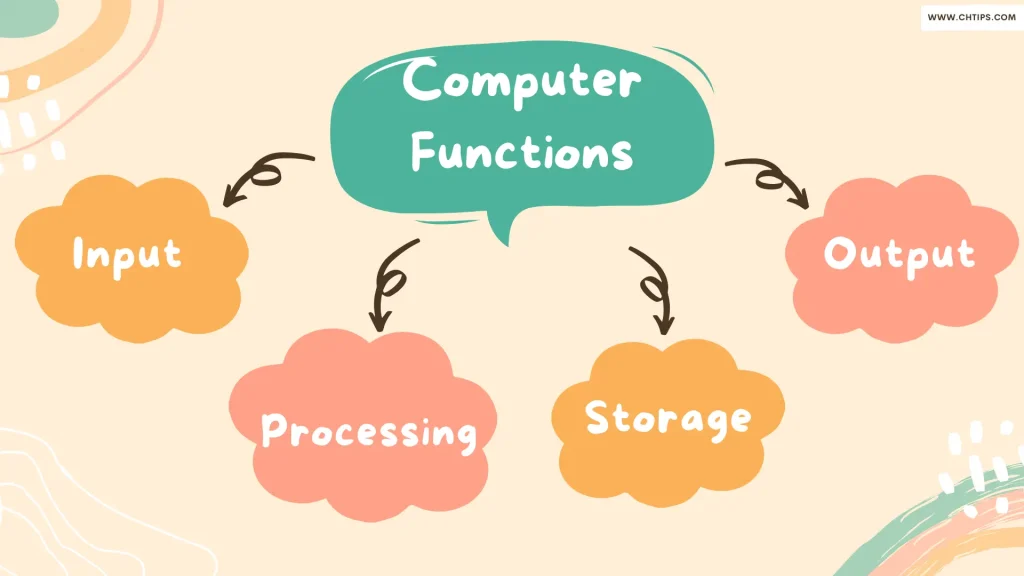

Functions of Computer System

- Input

- Output

- Processing

- Storage

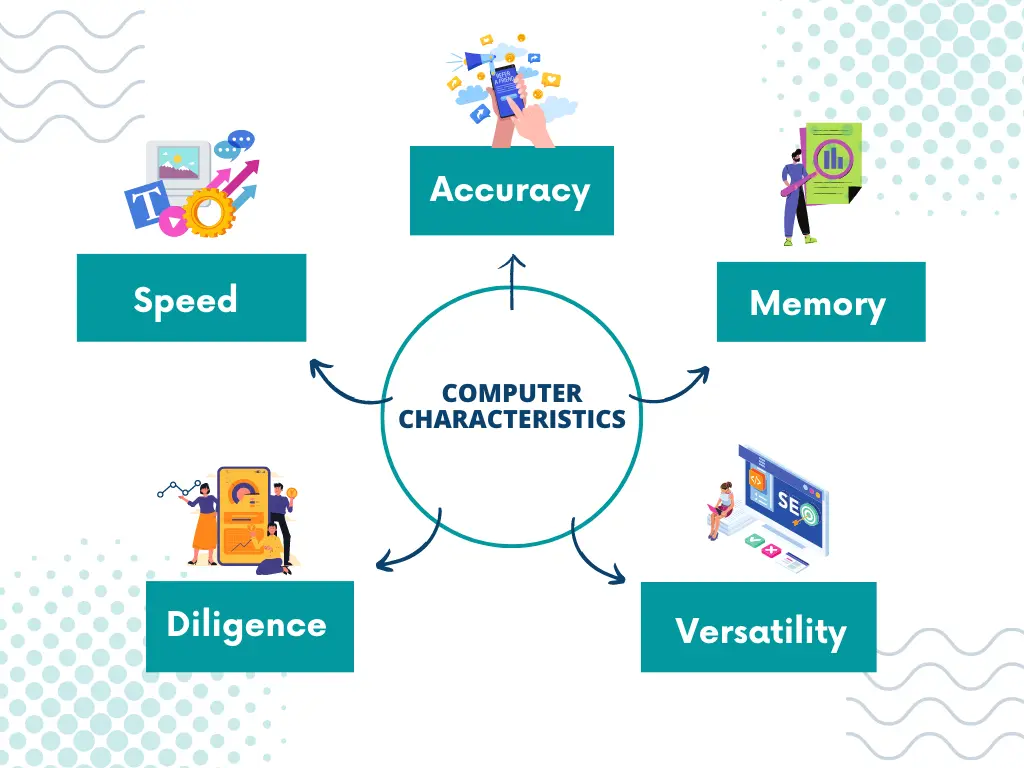

5 Characteristics of Computer System

- Speed

- Accuracy

- Memory

- Diligence

- Versatility

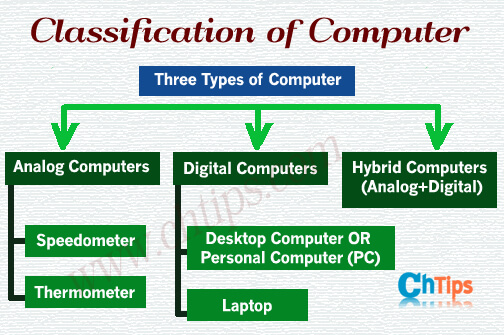

Classifications of Computer System

Computers are classified into three main types

- Analog Computers

- Digital Computers

- Hybrid Computers (Analog + Digital)

Frequently Asked Questions [FAQs]

Advantages of Cyber Security Insurance?

1. Financial Protection.

2. Risk Management.

3. Business Continuity.

4. Reputation Management.

5. Compliance.

6. Peace of Mind.

Uses Computer in Finance?

1. Accounting.

2. Trading.

3. Financial Analysis.

4. Banking.

5. Insurance.

6. Investment Banking.

7. Financial Planning.

Is Computer Vision Used in Finance?

Yes, computer vision is used in finance.

What Technology Do Banks Use?

Cloud Computing, Edge Computing, Artificial Intelligence, and Machine Learning.

Which Industry Uses Computer Vision?

Security, healthcare, automotive, logistics, and agriculture.

Top 5 Computer Brands

1. Compaq.

2. Dell.

3. HP.

4. Lenovo.

What are the Features of a Computer?

The main reason behind computer success is its most impressive and reliable features.

1. Speed

2. Accuracy

3. Diligence

4. Versatility

5. Memory

6. Reliability

5 Uses of Computer

1. Education

2. Technology

3. Business

4. Hospitals

5. Banking

Get In Touch

I have also written and compiled some articles on computers and telecommunications, and please go through them.

I hope you will like reading it.

All the questions and queries related to the Uses of Computers in Insurance Sectors have been answered here.

If you have any questions about Applications of Computers in Insurance Sector and Companies.

Don’t hesitate to contact me, and if you need to add, remove, or update anything from the article, please let me know in the comment section or via email.

I will be more than happy to update the article. I am always ready to correct myself.

I would like you to share this article with your friends and colleagues; this motivates me to write more on related topics.

!!! Thank You !!!

Comments are closed.