Introduction to Uses of Computers

In this modern generation, online transactions have reached a height. The user prefers online transactions over the traditional way of banking.

This online transaction can be done using mobile apps and websites with security, speed and accuracy. Online transactions are done in just a few clicks, reducing the time for banking with more convincing, reliable, and trusting.

These mobile apps and applications are easy to use and handle. Also, they are designed and developed to be user-friendly, focusing on user satisfaction.

There are significant characteristics and features of computers, and therefore, computers are used and utilized extensively in the banking sector. Computers can help update account information, maintain user personal details, and analyze data.

Modern computers can perform tasks and operations with speed and accuracy. Therefore, the uses of computers in banking sectors and applications of computers in the banking sector are visible.

What is Computer Banking and its Uses?

Computer banking uses modern computer technology and electronic system to provide banking services.

Computer banking is also called "Electronic Banking" and "E-Banking".

This computer technology is highly secure that works with speedy and accurate transactions. Therefore, most banks have successfully accepted and integrated this technology into their core system.

This technology is simple to use and integrate; its primary benefit is that it is inexpensive and user-friendly.

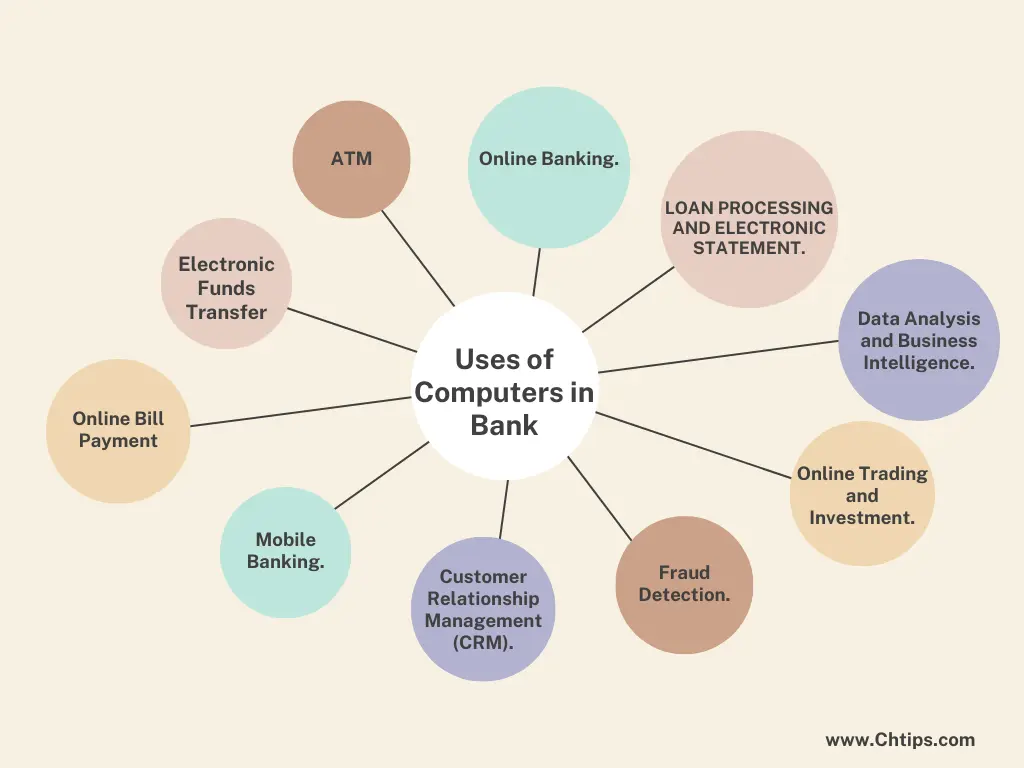

10 Uses of Computers in Bank in Tabular Form

The modern computer with excellent processing power has revolutionized the entire banking sector. The computers help customers with great speed and 100% accuracy in all their financial matters.

Here 10 uses of computers in banking sectors are included in tabular Form.

| # | Uses of Computers in Banking Sector |

| 1 | Online Banking. |

| 2 | ATM (Automated Teller Machine). |

| 3 | Electronic Funds Transfer (EFT). |

| 4 | Online Bill Payment | Computerized Info Bank. |

| 5 | Mobile Banking. |

| 6 | Customer Relationship Management (CRM). |

| 7 | Fraud Detection. |

| 8 | Online Trading and Investment. |

| 9 | Data Analysis and Business Intelligence. |

| 10 | Loan Processing and Electronic Statement. |

1. Online Banking.

Online Banking can be performed using computers, laptops and mobile devices with the use and assistance of an Internet connection.

With the help and assistance of online banking, customers can make online transactions, manage accounts, receive online bank statements, update passbooks, etc.

This online transaction can be done with an additional layer of security, which a powerful bank server provides.

Online banking has become an integral part of our daily life; these bank transactions can be done at our convenience.

2. ATM (Automated Teller Machine).

ATM stands for Automated Teller Machine.

ATM is an electronic computational machine that can perform basic and advanced banking features with just a few clicks.

Customers can withdraw cash, deposit cash, check transaction history, check account balance, and mini bank statement using an ATM.

The ATMs are user-friendly computer display machines that can be used by entering secret 4-digit PINs made available by bank authorities.

ATMs are available 24/7 with convenience, secrecy, and accessibility, considerably reducing and saving precious customer time.

3. Electronic Funds Transfer (EFT).

EFT stands for Electronic Funds Transfer.

EFT is an advanced computerized technology that facilities and transfer electronic funds between two bank accounts and financial institution.

EFT’s main benefit and advantage is that it eliminates physical transactions using cash, DD [Demand Draft], and cheques.

EFT transactions can be performed with excellent security using advanced server and antihacking software | applications that are very difficult to hack and crack.

The EFT is primarily used and utilized in organizations where bulk transactions are needed with great speed and accuracy without delays.

4. Online Bill Payment | Computerized Info Bank.

Online Bill Payment can be performed using mobile apps and secured bank websites. Online bill payment is a secure way of making online transactions without delays and havoc.

Online bill payments avoid cash transactions and cheques to make transactions more swift and secure between users and vendors.

5. Mobile Banking.

Mobile Banking can be done with the help and utilization of mobile apps anytime and anywhere according to the user’s convenience.

These mobile apps are secure, reliable, and provided by the bank and financial institutes.

Mobile Banking offers online transactions, paying bills, and checking account details with authentication and convenience.

6. Customer Relationship Management (CRM).

CRM stands for Customer Relationship Management.

The customer-sensitive and personal data | information is stored in the software application to manage customer interactions and preferences.

CRM is a computer system that assists banks and financial institutes identify, analyzing and diagnosing customer data and information gathered from customers.

CRM use enables a higher rate of user satisfaction.

7. Fraud Detection.

Fraud Detection can be easily accomplished using advanced algorithms, machine learning and artificial learning. This modern technology also uses antihacking software and application to avoid online fraud and detect people who indulge in this sort of activity.

This modern technology helps in identifying and preventing fraud activities. This system automatically blocks such account holders who are suspicious and hence reduces the risk of online fraud.

8. Online Trading and Investment.

The modern computer with an internet connection enables users to trade stocks, real-time marketing analysis, investment tips, bonds, etc.

Online trading and investment can be traced according to user convenience with just a few clicks, with a high level of security features.

9. Data Analysis and Business Intelligence.

Modern technology and enhanced applications can gather information and analyze real-time financial data of users for better usability.

This data can help take further strategic and intelligent decisions for improving business and organization.

10. Loan Processing and Electronic Statement.

Online loan applications can be submitted online with a computer and internet connection; this process is faster and more accurate than old-fashioned manual work.

This online platform can significantly reduce the overall cost due to the minimal usage of paper, documents and time required to finalize the tasks and operations.

The loan can be received by creating an online account, validating personal information and submitting the mandatory documents for loans and finance.

All the essential process included in loan processing is completely automated with the help and assistance of a computer, internet connection and enhanced software applications.

These are just a few examples of how computers are used in the banking sector. Technology integration continues to bring new advancements and innovations, shaping the future of banking services.

Uses of Computers in Bank With Infographics

10 Benefits of Computers in the Banking Sector

Below I have mentioned 10 Benefits of Computer in the Banking Sector.

- Efficiency.

- Convenience and Reliability.

- 24/7 Availability.

- Speed and Accuracy.

- Cost Savings | Inexpensive.

- Enhanced Security features.

- Data Analysis and Real-Time Reporting.

- Improved Customer Service.

- Risk Management.

- Innovation

Recommended Reading

- Uses of Computers in Insurance Sectors | Applications of Computers

- Is Computer Insurance Worth it for IT Professionals

- Top 10+ Uses of Computers in Insurance Sectors

- 10 Uses of Computer in Different Fields

- How Computer Consultant Insurance Empowers Business

- Computer Basic Tutorials

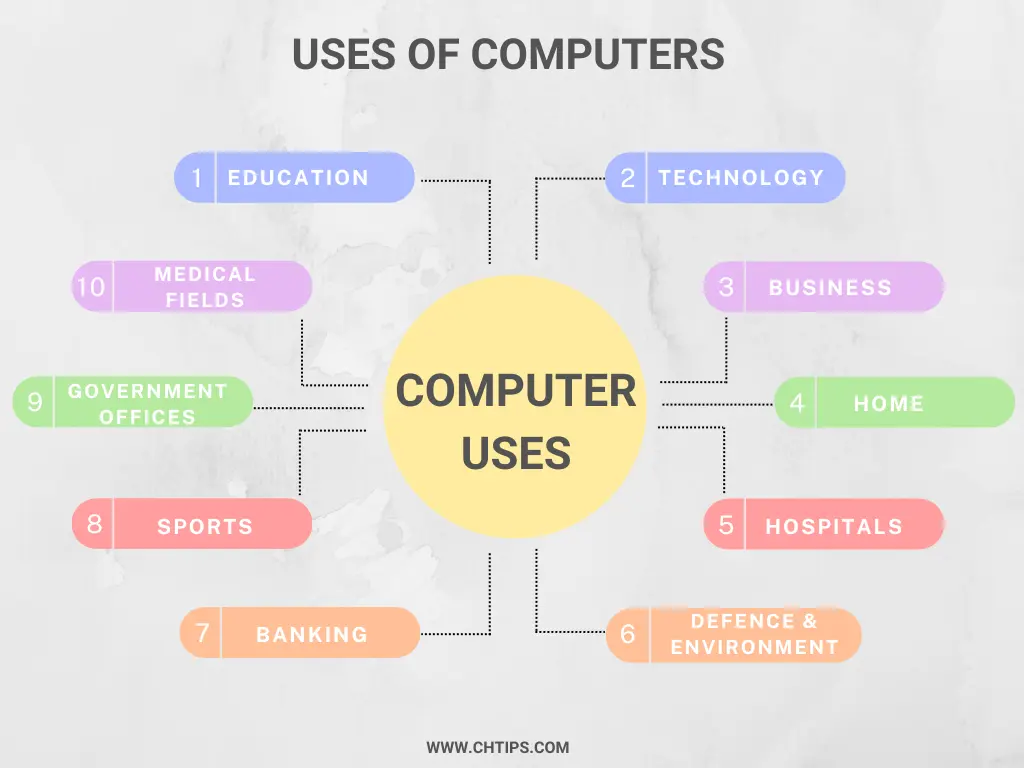

10 Uses of Computers in Different Fields

| 1 | Communications. |

| 2 | Information Retrieval. |

| 3 | Work & Productivity. |

| 4 | Education. |

| 5 | Entertainment. |

| 6 | Financial Management. |

| 7 | Shopping and E-Commerce. |

| 8 | Creative Working. |

| 9 | Health and Fitness. |

| 10 | Personal Organization. |

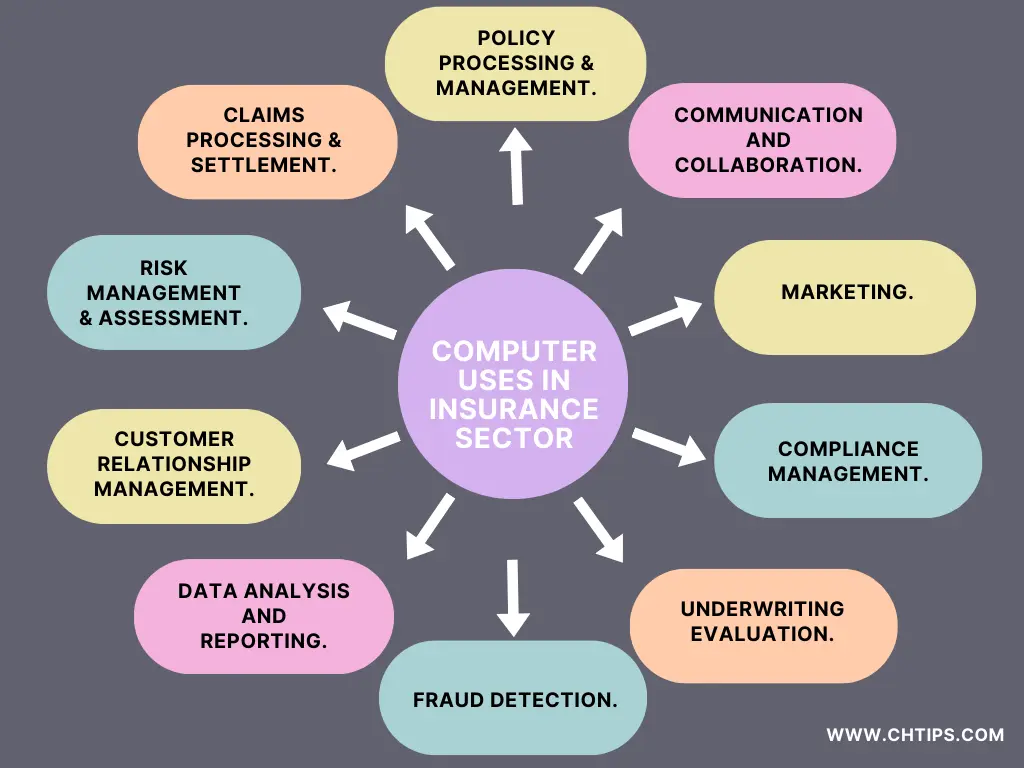

Uses of Computers in the Insurance Sector

| 1 | Policy Processing & Management. |

| 2 | Claims Processing & Settlement. |

| 3 | Risk Management & Assessment. |

| 4 | Customer Relationship Management. |

| 5 | Data Analysis and Reporting. |

| 6 | Fraud Detection. |

| 7 | Underwriting Evaluation. |

| 8 | Compliance Management. |

| 9 | Marketing. |

| 10 | Communication and Collaboration. |

5 Applications of Computers in the Banking Sector

- Online Banking with the Help of APPs.

- Data Management, Analytics and Reporting Tools.

- Core Banking Systems.

- Risk Alerts and Management with Additional Security Features.

- Electronic Funds Transfer.

How Computers Changed Banking?

Digital computers have significantly impacted how banks operate using computers in day-to-day work.

With the help of improved and enhanced technology, the working style of the banking sector has been dramatically changed.

Computers with internet connection and software applications can make the difficult and tedious banking job very simple to execute and implement.

The automated loan processing and handling process can significantly lower the burden of manual work with speed and accuracy.

These computer applications can lower the risk of data misuse with the help and assistance of additional security features with powerful and dedicated servers.

Fund transfers can be done with the help of enhanced technology called “EFT” [Electronic Funds Transfer].

This powerful technology primarily reduces the time taken for transactions with security and accuracy.

EFT avoid using cash and cheques.

Online transactions can be made with the help of a mobile app designed and developed by banks for easy and accurate transactions.

These apps can be used for checking bank details, online fund transfers, mini statements, etc.

Overall, many other features and characteristics of how computers have changed the banking sector.

Some of them I have mentioned that has empowered the overall banking sector.

Top 5 Banks in the World

- JPMorgan Chase.

- Bank of America.

- Bank of China.

- HSBC.

- Barclays.

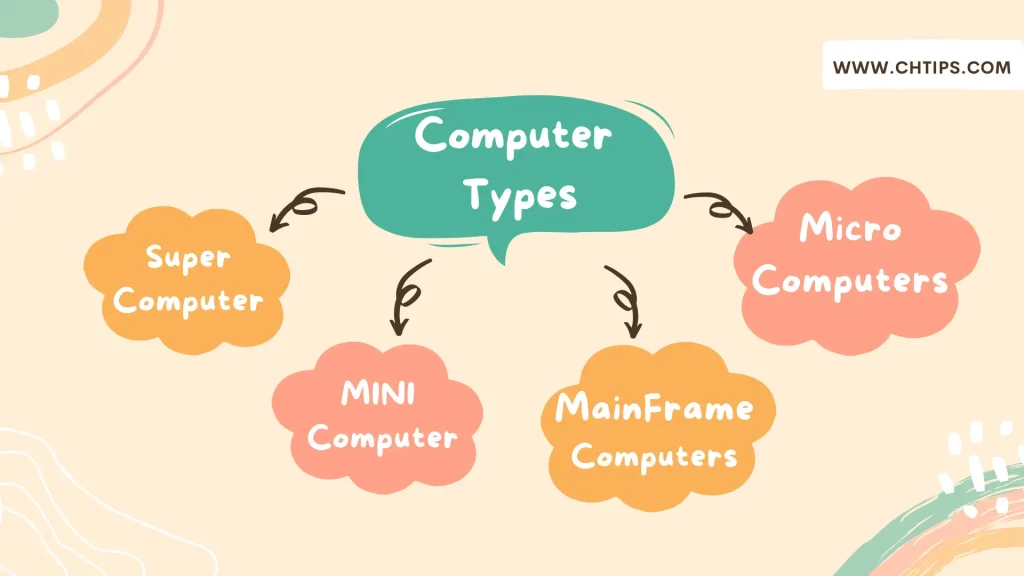

Different Types of Computer Systems

- Super Computer.

- Mainframe.

- Mini.

- Micro.

- Desktop.

- Laptop.

- Palmtop.

- Tablet PC.

Advantages and Disadvantages of Computer System

| # | Advantages of Computers | Disadvantages of Computers |

| 1 | Speed | Health Issues |

| 2 | Accuracy | Spread of Pornography |

| 3 | Stores Huge Volumes of Data & Information. | Virus and Hacking Attacks |

| 4 | Online Trading | Computer Can Not Take Their Own Decision and have NO IQ |

| 5 | Online Education | Distance Learning | Data and Information violation |

| 6 | Research | Negative Effect on the Environment |

| 7 | Forecasting Weather, Predicting Earthquakes, and Volcano Eruptions | Crashed Networks |

| 8 | In Business | The computer Can Not Work on Itself |

| 9 | Produce Employment | Spread of Violence and Hatred |

| 10 | Internet | Online Cyber Crimes |

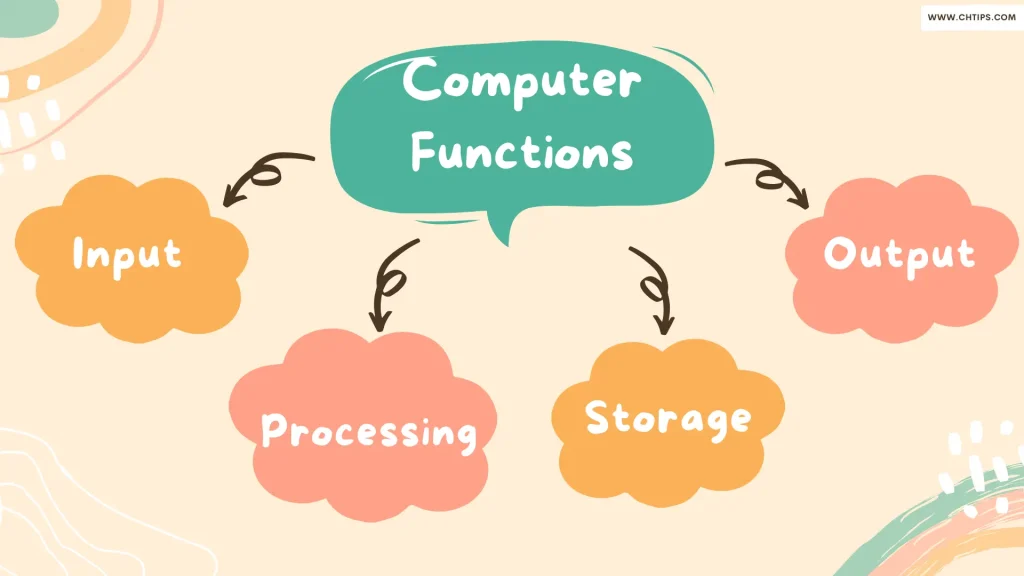

Functions of Computer System

The Four Basic Functions of Computer Systems are Mentioned Below

- Input.

- Output.

- Processing.

- Storage

Uses of Computers in the Banking Sector PDF Download

Helpful Video: Uses of Computers in Bank

Frequently Asked Questions [FAQs]

Five Uses of Computers in Bank

1. Core Banking System.

2. Risk Assessment.

3. Automated Clearing House (ACH).

4. Electronic Statements.

5. Online Customer Support.

6. Document Management.

7. Data Security and Encryption.

8. Decision Support Systems.

What are the 5 uses of computers in the office?

• Communication.

• Data and Information Management.

• Data Analysis.

• Mobile Computing.

• Graphic Design and Multimedia.

Which computer is used in banks?

Automated Teller Machine [ATM].

What is the first computer in banking?

The first computer used in banking was IBM 3614.

Who invented bank computers?

Luther Simjian in 1960.

When did banks start using computers?

The computer system was introduced in the banking sector in the 1960s.

What are the 4 types of banks?

Central Bank, Commercial Bank, Cooperative Banks, and Regional Rural Banks.

Top 5 Banks in the World

1.JPMorgan Chase.

2.Bank of America.

3.Bank of China.

4.HSBC.

5.Barclays.

Get In Touch

Computers play a vital role in the banking and finance sector. The impact of computers in banking made them an easy choice to replace the old traditional way of banking in financial institutes.

There is an evergreen scope of computers in banks with the help of modern technology such as Machine Learning and Artificial Intelligence made them more useful than ever before.

I have also written and compiled some articles on computers and telecommunications, and please go through them.

I hope you will like reading it.

All the questions and queries related to 10+ Uses of Computer in Banking Sector and Examples have been answered here.

If you have questions about the Applications of Computers in the Banking Sector.

Don’t hesitate to contact me, and if you need to add, remove, or update anything from the article, please let me know in the comment section or via email.

I will be more than happy to update the article. I am always ready to correct myself.

I would like you to share this article with your friends and colleagues; this motivates me to write more on related topics.

!!! Thank You !!!